Modern real estate development & investment

From raw land through permits and entitlement, we turn potential into profitable projects. We also back and operate select businesses where we can shape outcomes

What we do

-

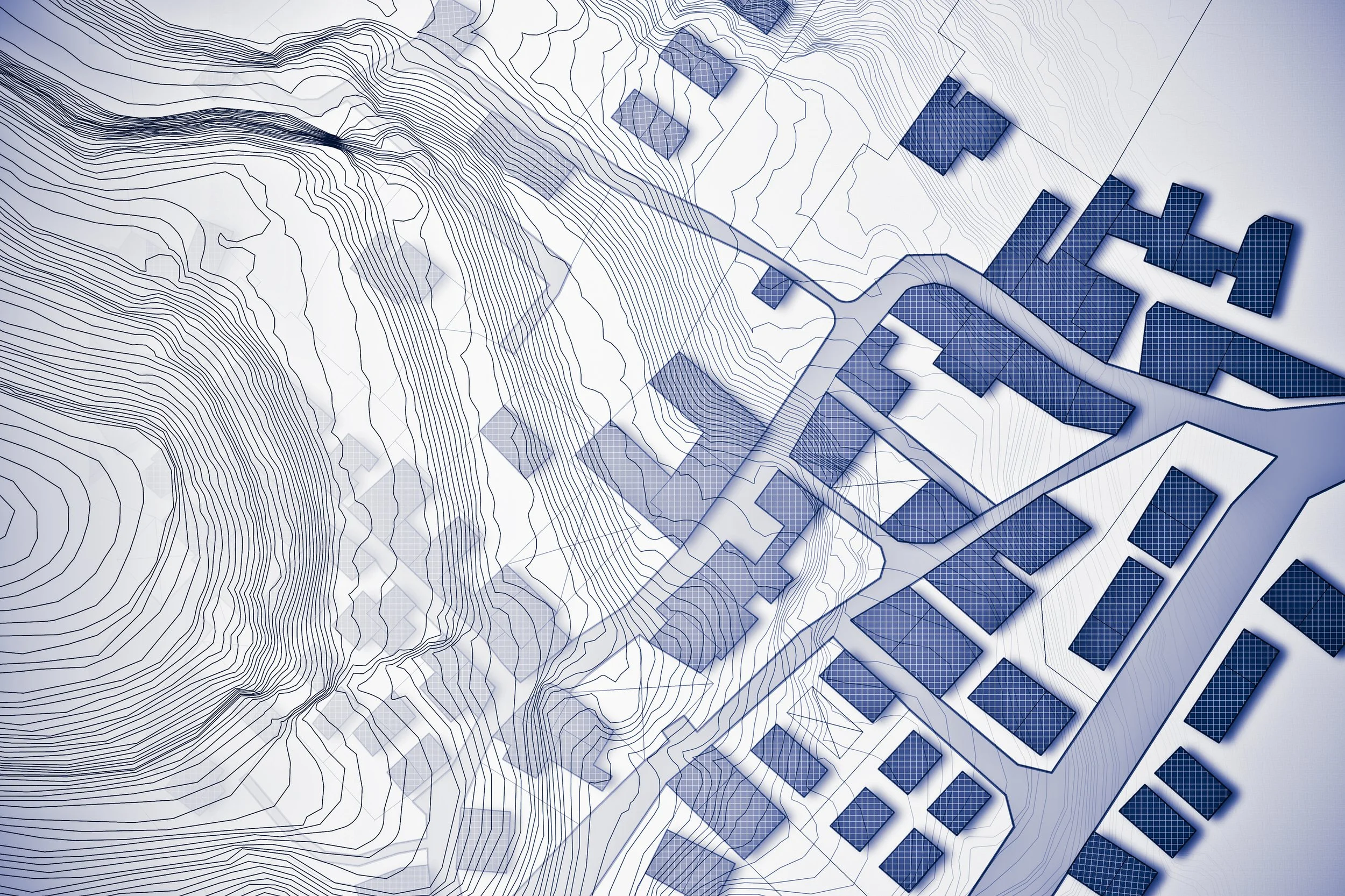

Development & Entitlement

We underwrite sites, lead civil and permitting, and deliver approved, shovel‑ready projects.

The examples highlight both disciplined execution of our development plans and opportunistic outcomes when market conditions create exceptional opportunities, such as early exits that deliver strong investor returns.

-

Investments

We place capital in real estate and operating companies—sometimes active operators, sometimes passive partners.

Our approach spans active development projects, operating business investments like Ron’s Pub, and passive placements with trusted partners. This flexibility allows us to pursue opportunities where we have edge while diversifying across strategies.

-

Property Management (Selective)

We provide professional operations for legacy assets with a focus on tenant support and property performance. Current residents and applicants are served through our dedicated property management platform which centralizes account access, payments, lease documents, and maintenance requests.

Learn more at MSEPM.LLC

Selected Entitlement & Development Projects

Why MSE?

Entitlement-first discipline: We unlock value before vertical construction.

Flexible mandate: Residential, mixed-use, and operating businesses where returns make sense.

Local execution: Houston-centric with relationships across utilities, engineering, and permitting.

Aligned capital: We invest alongside partners and communicate with precision.

Operating Investment Highlight

Ron’s Pub & White Horse Inn — Houston, TX

Neighborhood institution acquired, refreshed, and actively operated by MSE-affiliate Bar Wars Management LLC.

Our role: Capital + management

Thesis: Durable cashflow, brand stewardship, operational upside

Investor Overview

We target 12–20% IRR across 2–5 year hold periods depending on strategy and risk. Structures vary by deal; we prioritize clear waterfalls and investor communication.

Contact Us

Interested in working together? Have land or a project? Let’s talk about entitlement, partnership, or disposition.

Fill out some info and we will be in touch shortly. We can’t wait to hear from you!